Pope Francis, Virgil, and the Global Economy

by Nicholas D. Sawicki

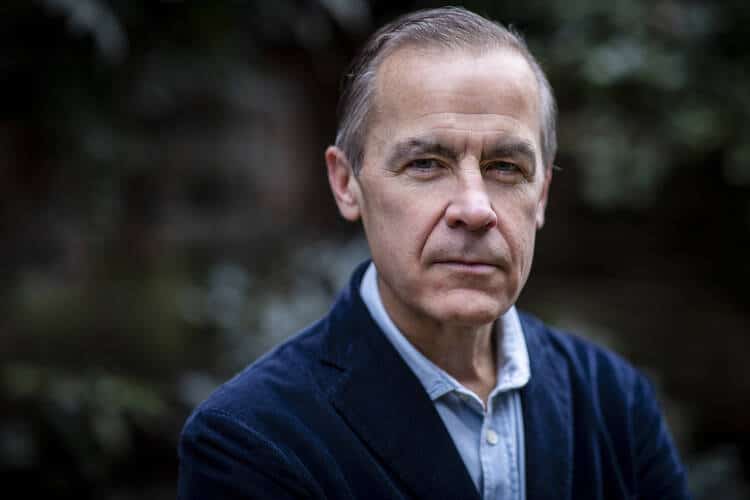

Photo by Toby Madden (Courtesy of Mark Carney)

Sic vos non vobis. This famous rebuke by the poet Virgil to the plagiarizer Bathyllus, “For you, but not yours,” frames Mark Carney’s new book Value(s): Building a Better World for All rather succinctly: We can either continue on the current path of what some argue is amoral wealth generation in a dehumanizing market society, or we can build new systems, grounded in common values, that encourage growth while stewarding resources for future generations. Virgil’s words, carved into a wall at Carney’s old haunt at the Bank of England in London, remind us that we may enjoy what has been handed down to us, but with the recognition that we too must pass it along.

Carney draws on nearly two decades of experience in writing Value(s). He was the governor of the Bank of Canada (2008-13) and governor of the Bank of England (2013-20) and is now the United Nations’ special envoy for climate action and finance. Additionally, Carney is the finance advisor for British Prime Minister Boris Johnson in preparations for the U.N.’s COP26 climate change conference in Scotland later this year. His career in private and public banking has provided him with a wide array of experiences, acquaintances and firsthand knowledge of financial systems, all of which he has drawn upon in writing this blueprint for a more equitable global economy that serves all people.

PAPAL INSPIRATION

Value(s) may be the first book from a former central banker that not only calls for an entire re-evaluation of the underpinnings of market forces, but cites a metaphor used by Pope Francis as a central inspiration. “I was at a meeting that the Vatican had with a wide range of people about the market economy and the social market economy,” Mr. Carney said in an interview with America. “It was around the time of the Argentina-Germany World Cup match in 2014, and the pope came into a lunch we were having and surprised us all.”

“The pope’s lesson, as Carney relates it in Value(s), was relatively straightforward: Wine, which was served with their meal, is many things and enlivens the senses. But grappa, which was served at the end of the meal, is but one thing: alcohol distilled. Drawing on this theme, Pope Francis likened humanity in its diversity and richness to wine, and the marketplace to grappa—humanity distilled. The job of those present, the pope said, was to turn grappa back into wine, the market back into humanity. “What I took from his parable was the question: To what extent can you turn the market back into humanity? And what are the values over time that preserve the best of the market but also more broadly serve society?” Mr. Carney said.

Mark Carney draws on nearly two decades of experience in writing Value(s).

“With over 500 pages, the book meticulously lays out Carney’s argument that the market is not fundamentally amoral but that there are existential threats that will require broad cooperation across markets, governments and societies to meet the pope’s challenge. Mr. Carney’s writing, while not explicitly invoking Pope Pius XI’s encyclical Quadragesimo Anno adheres closely to the notion laid out by Pius XI that both libertarianism and collectivism are the “twin rocks of shipwreck,” the Scylla and Charybdis between which we must chart a safe passage.

The market economy is a fundamental good of modern society, Carney is quick to note, but “if market fundamentalism becomes the dominant force relevant to the state…it will undercut some of the values that are necessary for proper market functioning.” Particular values, if recognized and incentivized, can promote sustainable market growth, encourage the benefits of competition and create more equitable economies. This requires a shared value system.

“Moral sentiments can be passed down and preserved, but they can be corroded, and that undercuts markets,” Mr. Carney said. “Bringing the sacred into markets can have the same effect. How do we strike the balance so that we can secure the moral underpinnings that [also] allow markets to function well?”

Striking such a balance, he said, requires the proper deployment of social capital. But social capital, which dictates what, how and why societies value what they do, is always at risk of being devalued in a market society. “[U]nchecked market fundamentalism,” Carney writes in Value(s), “devours the social capital essential for the long-term dynamism of capitalism itself.” While affirming the benefits of a free market and acclaiming the power of capitalism-driven dynamism, Carney sees clearly through the tattered shroud; as society sets a price on everything and affixes a market value to everything, it reduces its own ability to change and meet new challenges.

While Carney lays out clear evidence of how increasing economic disparities slow growth in developed economies, his principal objective is a sociophilosophical one: how to sustain values in the marketplace that reflect social demand.

After the global financial crisis of 2008, central bankers “did a series of things to align incentives for senior managers at banks with the long-term benefit of their institution and their clients as a whole. For example, to make sure not to allow excessive risk to build up,” said Mr. Carney. “There’s a concept in economics called ‘divine coincidence’—the idea that corporations who do good and treat their employees well also have strong financial returns. But the more this happens, the less it stands out. That’s what we call progress. For example, there are some fossil fuel companies that are taking their cash flow and investing in and transforming themselves to prepare for the future.”

“What I try to show,” he explained, “is that these are the types of opportunities and measures that reinforce these values and align with your interests. It’s not as high a bar as forgoing profit, but it is more likely to succeed in the long term.”

As a former central banker, Mark Carney retains a skeptic’s outlook on unbridled markets.

REGULATIONS AND INNOVATIONS

“The challenge,” said Mr. Carney, “is managing the regulatory pendulum. In finance, we had a ‘light touch’ pendulum and had to put in place regulations that got us back to the center.” The worry for any regulator in such a situation is that “you are creating conditions that stifle competition and innovation…. [And] you do not know what innovation is coming down the line next.”

As a former central banker, Carney retains a skeptic’s outlook on unbridled markets. His own predecessor at the Bank of England, the late Robin Leigh-Pemberton, once noted the perception of central bankers as “rather gloomy, possibly pessimistic, certainly a restrictive sort of people.” But approaching the issue as someone who managed the 2008 financial crisis as the governor of the Bank of Canada and dealt with the beginning of the Covid-19–spurred financial crisis in England, Carney disagrees with this characterization.

“As a central banker, I can’t always show you that the measures I’ve taken or my colleagues have taken prevented massive loss or instability, and after a while we begin to look like this expensive operation that isn’t doing very much. But the effects of good policy in the market prevent crises and encourage stability,” Mr. Carney said. “We do have a frequency of crises that have some value elements to it. What’s the downside of reinforcing, from a ‘no-regret’ perspective, the values that appear to help markets function well and for society more broadly? And then try and strike the balance of what should be in the market? And be more conscious of the corrosion factor that would have us pricing everything?”

A FOURTH INDUSTRIAL REVOLUTION

In addition to the challenges created by credit crises, climate change and now the Covid-19 pandemic, Value(s) also addresses the oncoming “fourth industrial revolution,” a term for the digital revolution that will prove as disruptive to our society as the previous socioeconomic revolutions that were powered by steam, electricity and information, and what it will mean for both the free market and the regulators. In particular, Carney sees the challenges of upcoming market shifts as sources of volatility and opportunity that must be managed and seized upon before they happen.

“The experience of previous periods of big technological change, industrial revolutions, is that there are these longer periods of increased inequality, lots of displacement,” Mr. Carney said, “and our response is so very much after the fact. We gradually learn into the response—e.g., education institutions, financial changes, social welfare and more.”

From Carney’s perspective, no particular social or economic sector is safe from the forthcoming upheaval. “I think the first thing is recognizing that the potential scale of what’s coming, particularly on the digital side, is quite profound and could lead to a very long period of adjustment for both blue- and white-collar workers,” he said, “those holding jobs that felt pretty secure but that the algorithm is coming for.” Nevertheless, he holds out hope that “when the economy reorganizes, it will be more distributed, more dispersed and potentially more equal with a broader range of opportunity.”

“The ability to be part of commercial creation, either because you have your own business or as part of a major corporation, raises the question: What are we doing to make commercial creation possible? There are big challenges that could accelerate inequality for a longer period of time,” he continued. “Can we be deliberate about it? Can we incentivize societies to invest more in people than just particular sectors of the economy? Can we invest in human development ahead of the technological curve?”

Carney holds out hope that “when the economy reorganizes, it will be more distributed, more dispersed and potentially more equal with a broader range of opportunity.”

RESILIENCE IS KEY

One of the key values Carney highlights is “resilience.” “We need to deliver resilience to the system,” he said. “We need a system that doesn’t blow over because there’s a crisis somewhere. But we can’t have the resilience of the graveyard.” As regulators, “we need to have a very pro-competitive stance so that you are creating opportunity for different financial businesses to compete to provide services. This stops you from being captured by the mega-banks, it increases the quality of service, and it gives you some diversity in the system that helps prevent everyone from collapsing in a crisis.”

“Whether we’re digital by design or digital by default,” Mr. Carney observed, “we have to assess how we organize the economy around maximizing employment, maximizing business creation and creating more financial inclusion—all of which are manifestations of greater solidarity.”

Carney’s re-envisioning of the global economy is not limited to governments and market forces but is inclusive of society at large, including faith communities. “There is a non-exclusive role for faith communities to help shape the marketplace,” he said. “Friedrich Hayek wrote extensively on the moral underpinnings of markets, in particular on the Judeo-Christian values that underpin markets.” But while aligning economic incentives with such values can help, “you can’t legislate virtue.”

Mr. Carney emphasized that “it’s about culture, and that’s a role that faith communities can play. The market is there to provide solutions for humanity, and the pendulum is swinging somewhat back in that direction that corporations are for people and that they have a responsibility.”

“Thus do ye, bees, for others make honey.” This, another line from Virgil, suggests that whatever is made is not meant to be hoarded; if it is, what good is it in this transient life? Early on in Virtue(s), Mr. Carney recognizes that “a sense of self must be accompanied by a sense of solidarity,” that the success of our global enterprise requires a recognition of the intertwined nature of individual and collective actions around the world. In answering the challenge set forth by Pope Francis, he provides not just individuals, but also societies and governments with a realistic and evidence-based blueprint for the tactics and values of building a more just and more equitable global society. Mr. Carney seeks to distill the market back into humanity, and to help us do the same.

This article also appeared in print, under the headline “Virgil, Pope Francis and the Global Economy,” in the Fall Literary Review 2021, issue.

Nicholas D. Sawicki is chief content officer at Crescite Innovation and a former member of the America Media staff. Follow him @NicholasSawick1

Courtesy of America Magazine